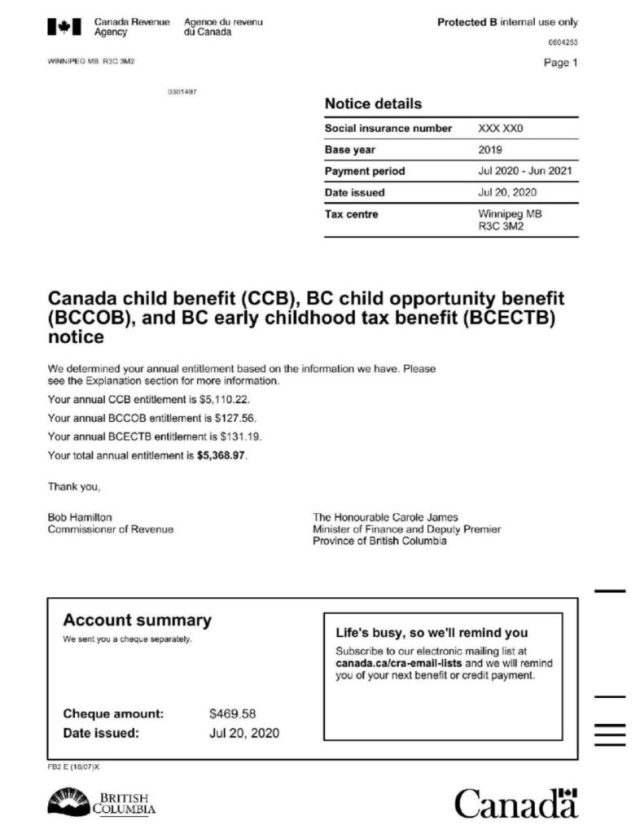

The Canada child benefit (CCB) is a tax-free monthly payment made to eligible families to help with the cost of raising children under 18 years of age. It is administered by the Canada Revenue Agency and you will receive an annual statement each year (typically in summer) showing the payments you will receive for the upcoming 12 month period. Here is a sample of the CCB annual Statement for reference:

CCB annual notice – sample doc

For specific details on the program, including a benefit calculator, see the government website:

For mortgage purposes, there are several lenders that will consider CCB income for use towards mortgage qualification. The lender will need to confirm your CCB income amount (by way of your most recent annual statement from Canada Revenue) and will also typically ask for confirmation of the ages of your children to confirm that you will continue receiving the CCB income for the duration of your mortgage term. For example, if you are taking a 5 year mortgage term, the lender will need to confirm your children are all ages 12 and under so that none will cross over the age 18 threshold of the CCB program during the mortgage term.